Research

Center Research

Selected research of Professor Christopher Berry:

Reassessing the Property Tax

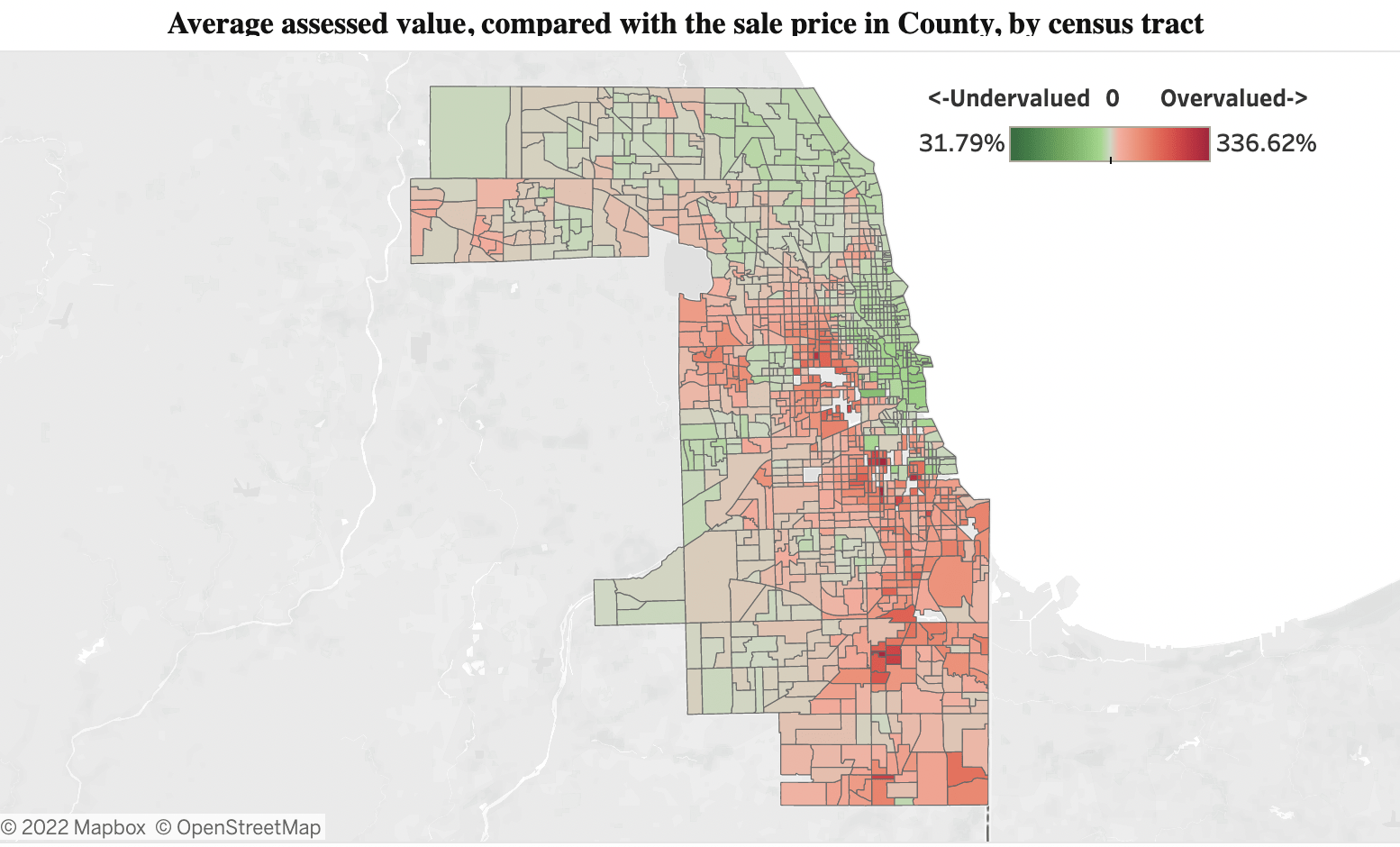

Abstract: The property tax is the single largest source of revenue for American local governments. It is designed to be an ad valorem tax. The fairness and accuracy of the tax hinges on the quality of property valuation by local assessors. Using data from millions of residential real estate transactions, this paper shows that assessments are typically regressive, with low-priced properties being assessed at a higher value, relative to their actual sale price, than are high-priced properties. Within a jurisdiction, homes in the bottom decile of sale price face an assessment level, as a proportion of price, that is twice as high as that faced by homes in the top decile, on average. As a result, the property tax disproportionately burdens owners of less valuable homes. Such regressivity is evident throughout the US. This result cannot be explained by measurement error in sale prices, or by explicit policy choices, such as assessment limits. Rather, regressivity appears to result from limitations in the data and methods used in assessment.

Taxed Out: Illegal property tax assessments and the epidemic of tax foreclosures in Detroit

Abstract: Detroit is experiencing historic levels of property tax foreclosure. More than 100,000 properties, or one-in-four throughout the city, have been foreclosed upon for nonpayment of property taxes since 2011. Simultaneously, there is strong evidence that the City is over assessing homeowners in violation of the Michigan Constitution, calling into question the record number of property tax foreclosures. This Article is the first attempt to measure the impact of unconstitutional tax assessments on property tax foreclosures. Analyzing residential properties that sold in Detroit since 2009, we show that properties assessed at higher rates were more likely to experience a subsequent tax foreclosure controlling for purchase price, location, and time-of-sale. We estimate that 10 percent of all these tax foreclosures were caused by illegally inflated tax assessments. Moreover, since lower priced homes were over assessed at a greater frequency and magnitude than higher priced homes, we estimate that 25 percent of tax foreclosures among homes in the bottom price quintile (less than $9,000 in sale price) were due to unconstitutional property tax assessments. Consequently, property tax malfeasance has unjustly displaced thousands of Detroit homeowners, most of whom are African-American. While the numbers in Detroit are extreme, there is reason to be concerned that similar practices are widespread.

See more on Professor Berry’s research on property tax fairness

Selected research of Professor Justin Marlowe:

Municipal Bonds in US Congressional Districts – CMF Research Briefs

Tax-exempt municipal bonds are the primary financing tool that state and local governments use to build roads, schools, water supply systems, public and non-profit hospitals and other public infrastructure. The goal of this research is to understand how tax-exempt municipal bonds impact communities. Using a first-of-its-kind dataset, we identify the types of state and local governments that use municipal bonds, and the types of infrastructure investments financed by those bonds, across US Congressional districts. This analysis allows us to explore previously-unknown patterns of municipal bond borrowing and investments both within and across regions.

“ESG Factors in Municipal Securities Disclosure: Toward a Materiality Concept,” Northern Illinois University Law Review 44(3)(2024): 195-222.

Abstract:State and local governments in the United States finance most of their infrastructure investment with debt instruments known as municipal bonds. The federal government does not directly regulate when or how municipal issuers access the municipal bond market, and only indirectly regulates the content of municipal borrowers’ disclosure to investors. A consequence of that unique regulatory structure is that municipal borrowers have wide discretion on whether to disclose falling property values, rising crime rates, and other long-term threats to their ability to repay investors. This is at odds with the ever-expanding information needs of investors who seek to align their holdings of municipal bonds with environmental, social & governance (ESG) investment principles. ESG investment requires detailed information about climate adaptation efforts, gender pay equity, cybersecurity, and factors not found in typical municipal disclosures. This raises a natural question: When is an ESG factor material to municipal bond investors, such that it would compel an issuer disclosure under the current municipal market regulatory framework? This article considers three potential approaches to this question. Following a review of the empirical literature on ESG risks in the municipal securities market, it suggests that municipal ESG concerns do not meet a materiality threshold from the regulated markets, but that certain ESG factors do meet the efficient market test and the creditworthiness test standards found elsewhere in securities law.

“Local Lodging Taxes During and After the Pandemic” (with Tom Hazinski), Municipal Finance Journal 44(1) (2023): 45-64.

Abstract: This paper examines the structure, recent and expected performance, and fiscal implications of the local lodging tax. Lodging taxes have become a uniquely important and interesting local revenue source as the pandemic has restructured many long-standing assumptions about the relationship between place and economic activity. Recent hotel revenue performance—a key proxy for lodging tax revenues—varies considerably across regions. Markets focused primarily on leisure travel have recovered to, and often exceeded, their pre-pandemic levels, whereas markets focused on commercial travel have generally not returned to their pre-pandemic levels. This leisure vs. commercial market distinction is also a strong predictor of hotel revenue recovery since the pandemic. Although local lodging taxes are a comparatively small share of general local revenues, they have noteworthy local fiscal implications. In many jurisdictions, they are equivalent to more than one-quarter of total non-property tax revenues. We also find that lodging taxes support roughly $14 billion in outstanding municipal debt, including several large bond issues in markets where lodging tax revenues have recovered slowly.

Municipal Finance Journal

The Center for Municipal Finance is proud to be the editorial home of the the Municipal Finance Journal, the only scholarly outlet dedicated to the municipal securities industry, and one of the leading journals in our field. Center Director Justin Marlowe also serves as Editor-in-Chief.

Municipal Finance Conference

The Center for Municipal Finance is one of the sponsors of the leading research conferences in municipal finance. Learn about the latest conference and see papers here.