Research

Center Research

Selected research of Professor Christopher Berry:

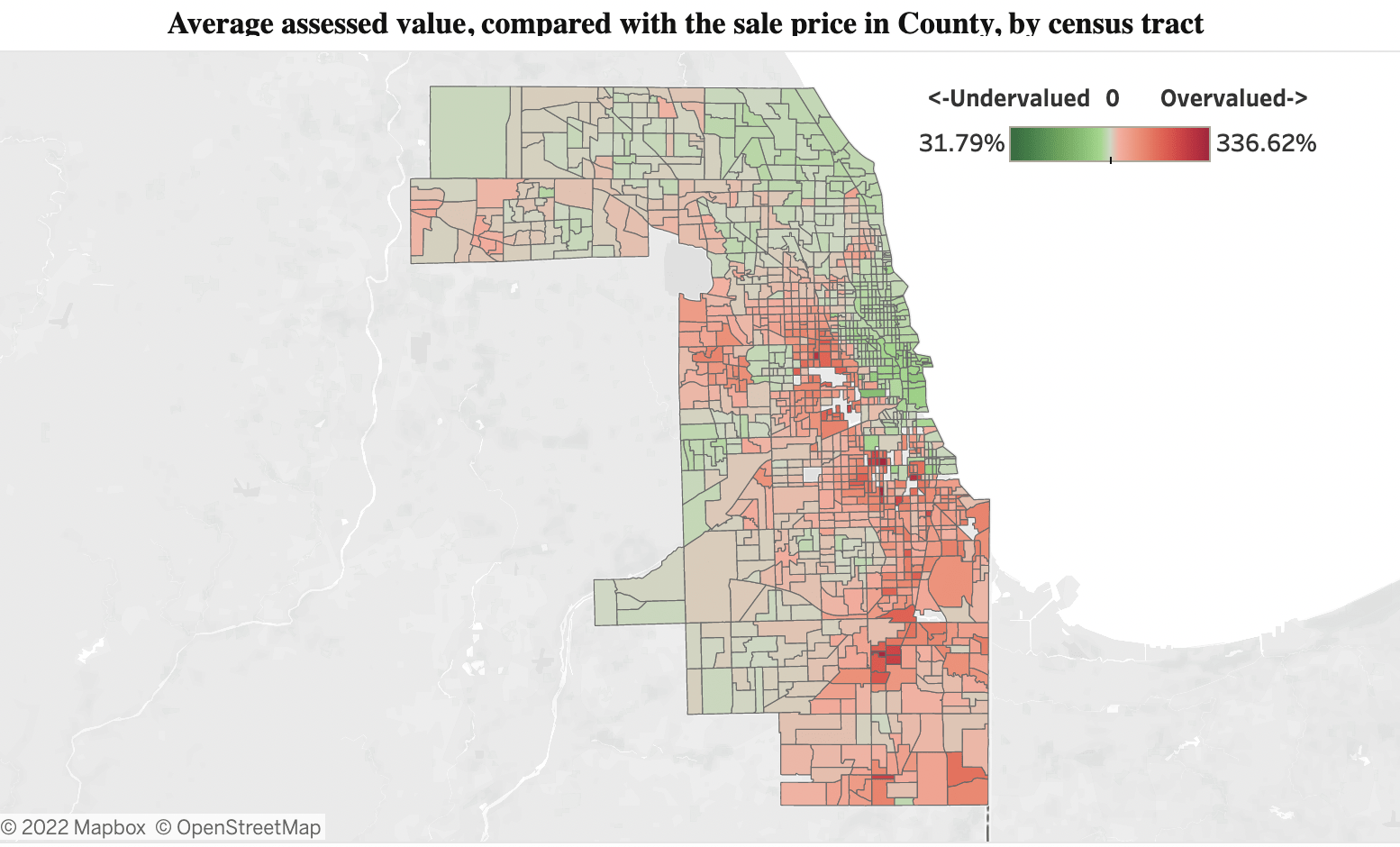

Reassessing the Property Tax

Abstract: The property tax is the single largest source of revenue for American local governments. It is designed to be an ad valorem tax. The fairness and accuracy of the tax hinges on the quality of property valuation by local assessors. Using data from millions of residential real estate transactions, this paper shows that assessments are typically regressive, with low-priced properties being assessed at a higher value, relative to their actual sale price, than are high-priced properties. Within a jurisdiction, homes in the bottom decile of sale price face an assessment level, as a proportion of price, that is twice as high as that faced by homes in the top decile, on average. As a result, the property tax disproportionately burdens owners of less valuable homes. Such regressivity is evident throughout the US. This result cannot be explained by measurement error in sale prices, or by explicit policy choices, such as assessment limits. Rather, regressivity appears to result from limitations in the data and methods used in assessment.

Taxed Out: Illegal property tax assessments and the epidemic of tax foreclosures in Detroit

Abstract: Detroit is experiencing historic levels of property tax foreclosure. More than 100,000 properties, or one-in-four throughout the city, have been foreclosed upon for nonpayment of property taxes since 2011. Simultaneously, there is strong evidence that the City is over assessing homeowners in violation of the Michigan Constitution, calling into question the record number of property tax foreclosures. This Article is the first attempt to measure the impact of unconstitutional tax assessments on property tax foreclosures. Analyzing residential properties that sold in Detroit since 2009, we show that properties assessed at higher rates were more likely to experience a subsequent tax foreclosure controlling for purchase price, location, and time-of-sale. We estimate that 10 percent of all these tax foreclosures were caused by illegally inflated tax assessments. Moreover, since lower priced homes were over assessed at a greater frequency and magnitude than higher priced homes, we estimate that 25 percent of tax foreclosures among homes in the bottom price quintile (less than $9,000 in sale price) were due to unconstitutional property tax assessments. Consequently, property tax malfeasance has unjustly displaced thousands of Detroit homeowners, most of whom are African-American. While the numbers in Detroit are extreme, there is reason to be concerned that similar practices are widespread.

See more on Professor Berry’s research on property tax fairness

Selected research of Professor Justin Marlowe:

Stories and Sentiment in State and Local Government Finance – Forthcoming at State and Local Government Review

Abstract: Budgets and financial statements convey essential information about revenues, expenditures, assets, and liabilities. But perhaps more important, they also convey positivity, negativity, fairness, uncertainty, and other social sentiments. This essay examines what we know, and what we need to know, about how state and local governments communicate financial sentiment. The main conclusion is that they do convey clear financial sentiments through traditional financial reporting methods and through new channels like social media. Moreover, those sentiments shift predictably in response to broader economic trends and policy priorities, and can shape how investors and other stakeholders view a government’s finances. This raises several practical questions about how states and localities can measure financial sentiment, and many normative questions about whether and how they ought to attempt to manage it. The discussion also includes a brief demonstration of how to extract financial sentiment from state and local Twitter activity.

Do Municipal Bond Exchange-Traded Funds Improve Market Quality?

Abstract: I examine the relationship between exchange-traded funds (ETFs) and the liquidity profiles of municipal bonds. Using data on the bond-level holdings of ETFs from 2010-2020, I find that bonds held by ETFs tend to trade more often than bonds held by mutual funds, but with little or no impact on price dispersion, returns, or systematic risk. However, these effects vary considerably by the type of bond. Lower credit quality bonds held by ETFs tend to trade much more frequently than those with higher credit quality. Market conditions also matter. During the COVID-19 market dislocation of March 2020, bonds held by ETFs traded far less often. These results have implications for regulators’ stated concerns about the liquidity differential between ETFs and their underlying holdings, especially during market downturns. My findings suggest that at best ETFs bolster municipal bond liquidity overall, and at worst, bonds held by ETFs are no less liquid than bonds held in mutual funds.

“Aptitude, Accountability, and Adaptation: Research Themes for Public Budgeting, Financial Management and Accountability.” In the Routledge Handbook of Public Administration, 4th ed. (forthcoming 2021), eds. Bart Hildreth, Ev Lindquist, and Gerald Miller (New York: Routledge).

Journal of Public Budgeting and Finance

The Center for Municipal Finance is proud to be the editorial home of the JPBF, one of the leading journals in our field, with the CMF’s Associate Director, Justin Marlowe as the editor.

Learn more about the Journal of Public Budgeting and Finance

Municipal Finance Conference

The Center for Municipal Finance is one of the sponsors of the leading research conferences in municipal finance. Learn about the latest conference and see papers here.